Payment Posting

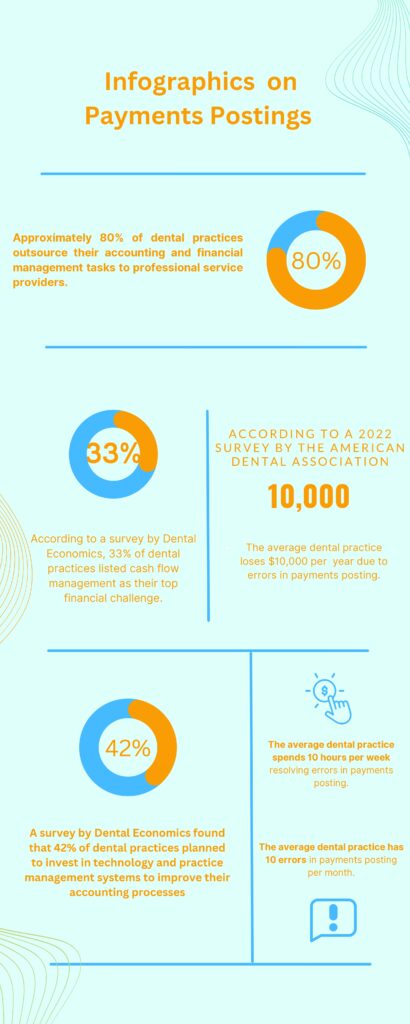

Does your front office staff face extreme challenges in collecting and posting payments? Payment posting could be time-consuming and costly. So, how does your front office staff handle them? As a dentist, How do you handle such a task without hiring more employees or spending a lot of money?

We offer you our Payment posting services, where payment posting is all about applying Insurance Payments to a claim and allocating it by procedure code in the Practice Management Software. finalizing the claim without forgetting to attach a scanned copy of the Explanation of Benefits or Electronic Remittance Advice or a PDF of the Explanation of Benefits which was extracted from the insurance company’s website.

We meticulously compare the claim details, input the insurance payment amount, determine the suitable write-off, and ultimately conclude the claim process by utilizing either a scanned Explanation of Benefits or electronic remittance advice.

We know that you and your team are busy serving the patients.

- Is your team posting the insurance payments received as soon as you receive them at the correct procedure code level?

- Do you know which procedures are being constantly underpaid by the Insurance company?

- Are you collecting the reminder from your patient before their next appointment?

- Are you enforcing your broken appointment policy by adding the fee to the patient account?

If you are unsure of the answers to any of these questions, you need to outsource your payment posting task to our dedicated, trained, highly qualified (Accountants in India) and significantly low-cost resources.

Our Payment posting service includes:

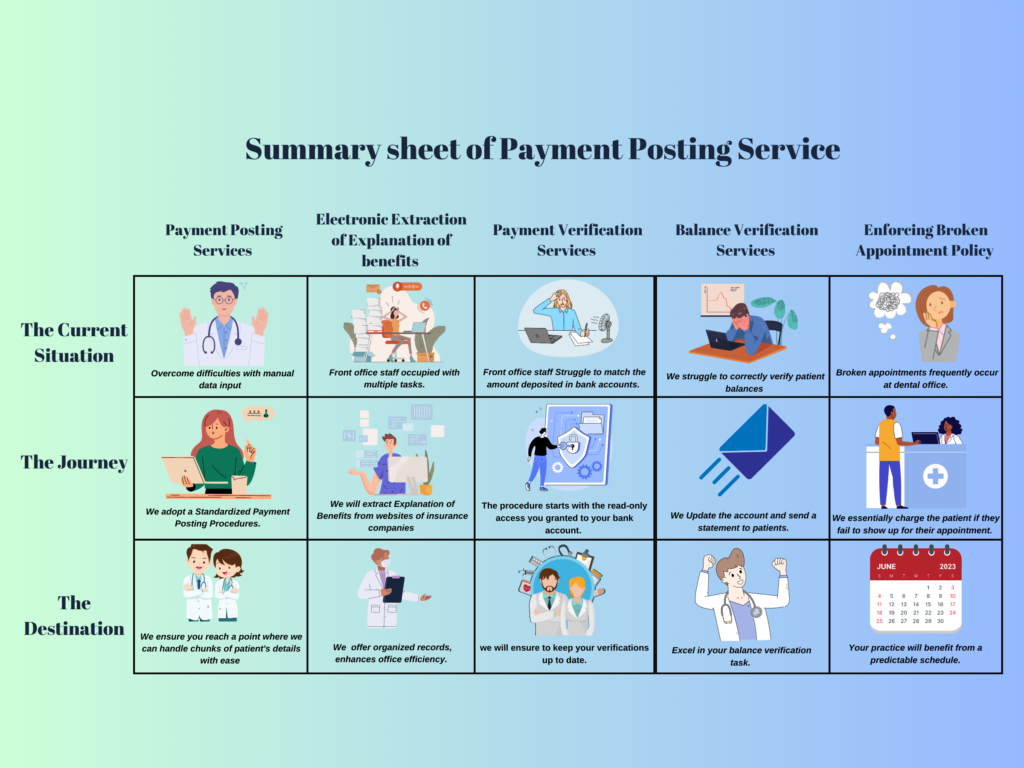

- Extraction of Explanation of Benefits (EOB)– We will extract Explanation of Benefits from the websites of insurance companies if logins were provided.

- Payment Verification Service- The procedure starts with the read-only access you granted to your bank account, which is used to verify electronic cash transfers and cheque deposits made by insurance companies, patients, and other parties based on explanations of benefits.

- Balance Verification Service- A balance verification service is all about Updating the account and sending a statement to patients, informing them of the Balance they have, the day before they come for the appointment.

- Enforcement of Broken Appointment Policy Service– We essentially charge the patient if they fail to show up for their appointment. Patients tend to respect their appointments more when they have to pay for broken appointments.

- Entering the payments – We enter the payment details to the claims and post the same in the Practice Management System (PMS).

Pricing

- Transactional Based Pricing

- Extraction of EOBs – per EFT ($0.40 cents)

- Payment Posting (per claim) – ($0.90 cents)

- Verification of Electronic Fund Transfer/ Cheque deposits ($0.50 cents)

- Balance Verification Services – ($5 per patient)

- Enforcing Broken Appointment Policy ($0.30 cents per broken appointment)

- Contact Now

- Volume Based Pricing

- Small Organisation $170/month – If Total Collections are less than $40k/month

- Medium Organisation $190/month – If Total Collection are between $40k – $100k/month

- Large Organisation $230/month – If Total Collection are between $100k – $150k/month

- Enterprise Organisation $260/month – If Total Collection are more than $150k/month

- Contact Now

- Resource Based Pricing

- Full Time Resource – $1000

- Part Time Resource – $600

- Hourly Basis – $10/hr

- Contact Now

Schedule a Meeting with our Payment Team

Total Number of broken appointments per month =

Revenue Loss =

Revenue + Broken Loss =

Brochure

Presentation

e-Book

White Cost Savings Downloadable file

Case Study

White Paper

In today’s dynamic healthcare landscape, dental practices are experiencing significant transformations driven by technological advancements, changing patient expectations, and a rising tide of competitive rivalry. This abstract aims to provide an attractive and informative overview of the evolving dental industry, highlighting the key factors contributing to its transformation and the challenges posed by increased competition.

Solo Dentist – From Burden to Bliss, Payment Posting Services Empower Solo Dentists

As a solo dentist, your responsibilities extend far beyond patient care. You find yourself juggling multiple roles, including strategist, HR manager, finance manager, operations manager, marketer, IT manager, web developer, SEO expert, accountant, and procurement manager. Amidst these numerous hats, the task of payment posting often falls on your office manager, whose ability to handle it efficiently can impact your practice’s cash flow.

By entrusting payment posting to a dedicated team of trained and highly qualified accountants in India, you can experience several benefits that contribute to the efficient running of your dental practice:

- Time and Focus: Outsourcing payment posting allows you to reclaim valuable time and redirect your focus towards core dentistry tasks. Instead of grappling with financial intricacies, you can concentrate on providing quality care to your patients and growing your practice.

- Cost Savings: Hiring and maintaining an in-house accounting team can be expensive, especially for a solo dentist or small dental clinic. Outsourcing payment posting services to skilled professionals in India provides a cost-effective alternative. You can benefit from the expertise of trained accountants at a significantly lower cost, saving on salaries, benefits, office space, and equipment.

- Expertise and Accuracy: The dedicated accountants handling your payment posting possess the necessary expertise and knowledge in financial management. Their specialized skills ensure accurate processing and recording of payments, reducing errors and potential delays. You can rely on their proficiency in handling insurance reconciliations and maintaining precise financial records.

- Timely and Consistent Cash Flow: By outsourcing payment posting, you can avoid bottlenecks caused by delays in processing payments. The dedicated team focuses solely on promptly posting payments, ensuring that your cash flow remains steady. This enables you to maintain financial stability and meet your practice’s operational expenses without disruption.

- Scalability and Flexibility: Outsourcing payment posting services provides scalability to adapt to your practice’s evolving needs. Whether you experience a surge in patient volume or decide to expand your services, the outsourcing provider can accommodate the fluctuating requirements seamlessly. You can scale up or down as needed without the burden of hiring or training additional staff.

- Security and Confidentiality: Reputable outsourcing providers adhere to strict security protocols to protect your practice’s financial data. They employ secure technology platforms and maintain confidentiality, safeguarding sensitive patient and financial information.

- Enhanced Practice Management: By offloading payment posting responsibilities to experts, you can optimize your practice management processes. With accurate and timely financial records, you gain valuable insights into your revenue streams, enabling informed decision-making for improved profitability and growth.

- Expert Analysis and Insights: The outsourcing provider’s experienced accountants possess a deep understanding of insurance billing and reimbursement processes. They conduct thorough analyses of insurance payments, identifying trends and patterns that could lead to potential revenue optimization opportunities. Their insights enable you to make informed decisions and implement strategies to mitigate underpayments.

- Centralized Receivables Management: Outsourcing payment posting allows for centralized receivables management across your regional group practice. Instead of each practice handling insurance payments individually, a dedicated team consolidates and manages receivables, ensuring consistency and efficiency in the process. This centralization improves cash flow management and reduces the administrative burden on individual practices.

- Timely Payment Processing: The outsourced payment posting team focuses solely on timely and accurate payment processing. By ensuring prompt submission of insurance claims and diligent follow-up, they optimize reimbursement turnaround times. This leads to improved cash flow and reduced instances of delayed or underpaid claims.

- Streamlined Accounting Processes: The dedicated professionals handling payment posting employ standardized accounting processes and procedures. This consistency and adherence to best practices streamline the overall accounting functions within your regional group practice. It allows for more accurate financial reporting, easier audits, and better financial decision-making.

- Scalability and Flexibility: As your regional group practice grows, outsourcing payment posting services can seamlessly scale to meet your evolving needs. Whether you acquire new practices or expand your network, the outsourced provider can adapt to the increased volume and complexity of insurance reimbursements. This scalability ensures continuity and efficient receivables management as your practice expands.

- Cost-Effective Solution: Outsourcing payment posting services offers a cost-effective solution compared to hiring and maintaining an in-house team. It eliminates the need for additional staff, training, and equipment expenses. By leveraging the expertise of outsourced professionals, you achieve improved financial outcomes while minimizing operational costs.

- By outsourcing payment posting services in your regional group practice, you can achieve centralized and streamlined receivables management. The expert analysis, enhanced visibility, and efficient processes provided by the outsourced team optimize your revenue and allow you to focus on driving aggressive growth. With better control over insurance reimbursements, you can enhance financial performance, strengthen your practice’s reputation, and continue expanding successfully.

- Consistency and Accuracy: The dedicated team of professionals, including highly qualified accountants in India, ensures consistent and accurate payment posting. They adhere to standardized procedures and best practices, eliminating islands of methods and procedures within your practices. This uniformity streamlines the payment posting process and minimizes errors, improving efficiency and reducing the risk of underpayments.

- Management Reports for Decision-Making: Outsourcing payment posting services offers the advantage of comprehensive management reports. These reports provide detailed insights into financial performance, reimbursement trends, and potential areas for improvement. By leveraging these reports, you can make data-driven decisions, implement strategic changes, and optimize revenue generation at a fraction of your current cost structure.

- Enhanced Visibility and Transparency: With the help of the dedicated team, you gain better visibility into services that insurance companies consistently underpay. The centralized approach to payment posting ensures transparency and allows you to monitor and address underpayment issues more effectively. This transparency promotes a culture of accountability and facilitates continuous improvement across your national group practices.

- Cost-Effective Resource Allocation: Outsourcing payment posting to a team of highly qualified professionals in India offers significant cost advantages. These resources provide the expertise required for accurate payment processing at a significantly lower cost compared to maintaining an in-house team. By reallocating your resources to core dentistry tasks and leveraging cost-effective outsourcing, you can optimize your cost structure and drive financial efficiency. Scalability and Flexibility: The outsourced payment posting services can scale seamlessly to meet the needs of your expanding national group practices. Whether you acquire new practices or undergo significant growth, the outsourcing provider can accommodate the increased volume and complexity of payment processing. This scalability ensures consistent and efficient revenue management as your dental network expands.

- Focus on Core Dentistry Tasks: By outsourcing payment posting, you can alleviate the administrative burden on your team, allowing them to focus on core dentistry tasks. This shift in responsibilities improves productivity and enhances the patient experience. With a dedicated team managing payment posting, you can dedicate more time and attention to providing quality dental care and growing your national group practices.

- Outsourcing payment posting services in your national group practice empowers you with AI-enabled reports, consistency, accuracy, and improved visibility into underpayments. The dedicated team of professionals, trained accountants in India, offers cost-effective solutions, scalability, and the opportunity to optimize resource allocation. By leveraging these benefits, you can run your dental practice efficiently, drive revenue recovery, and sustain the growth of your national group.

Regional Group – Improvise your Practice’s Potential with Payment Posting Services across the state.

As a regional group practice aiming for aggressive growth, consolidating receivables management and accounting becomes a critical aspect of streamlining operations. Without proper consolidation, individual practices within the group may handle insurance payments independently, leading to a lack of visibility into consistent underpayments from insurance companies.

Enhanced Visibility: By outsourcing payment posting, you gain improved visibility into the services that insurance companies consistently underpay. The dedicated team of professionals scrutinizes insurance reimbursements across all your practices, identifying patterns of underpayment and discrepancies. This visibility empowers you to take proactive measures to address these issues and maximize revenue.

National Group – Elevate Your dental practices across the nation

As a national group dentist, rapid growth can sometimes lead to fragmented methods and procedures across your practices, hindering visibility into consistent underpayments from insurance companies. To address these challenges and run your dental practice efficiently, outsourcing payment posting services can prove highly beneficial.

AI-Enabled Reports for Problem Identification: By outsourcing payment posting services, you gain access to AI-enabled reporting capabilities. These reports utilize advanced algorithms to analyze data and identify problem areas where insurance companies consistently underpay. The insights provided help you pinpoint specific issues and take proactive measures to increase revenue recovery. It enables you to optimize reimbursement processes and maximize financial outcomes across your national group practices.

Services Offered by Todays Dental Partners

|

Experience unmatched payment posting servicesDoes your front office staff face extreme challenges in collecting and posting payment? Payment posting could be time-consuming and costly. So, how does your front office staff handle them? As a dentist, How do you handle such a task without hiring more employees or spending a lot of money? Our Payment Posting Service will help you to be up to date with the payments received from the Insurance companies and the patients, ensuring that your days outstanding are under control. |

|

Electronic Extraction of Explanation of Benefits ServicesIs your front office staff occupied with multiple tasks, does your front office staff have no time to extract explanations of benefits. Does your front office staff face any challenge to handle the extraction of explanation of benefits tasks? Our Explanation of Benefits (EOB’s) management service professionals retrieve the EOB’s from the Insurance Company websites or from a cloud location where you store the scanned copies of the Paper EOB’s and attach them to the patient file in your practice management system. |

|

Discover the power of verified payments for Seamless TransactionsDoes your front office staff Struggle to match the amount deposited in bank accounts and the amount mentioned on your Practice Management System? Through our payment verification service, we verify the Electronic fund transfer deposits and cheque deposits in the bank |

|

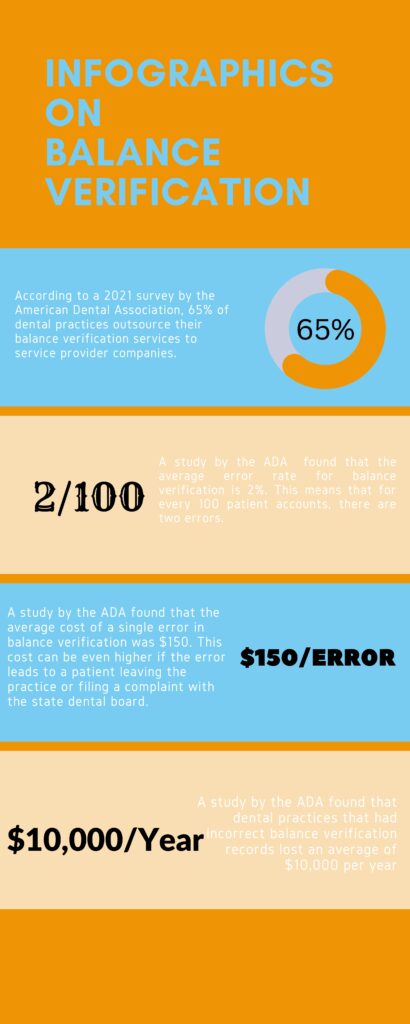

Embrace the confidence of verified balances for optimal peace of mindAre there any significant issues that your front office personnel have with the balance verification procedure? you may struggle to correctly verify patient balances because insurance providers may have delays in updating their systems or inconsistencies in the data they supply. With our Balance verification service, we go through the patient account in detail, a day prior to their appointment and ensure that the account balances are accurate. |

|

Elevate your practice with our Broken appointment policyDo broken appointments frequently occur at your dental office? It’s painful right, when patients fail to show up for their scheduled appointments or cancel at the last minute, it creates gaps in our schedule that are difficult to fill. These empty slots result in lost revenue and wasted time that could have been utilized for other patients in need of dental care. Our Broken Appointment management service helps you enforce your broken appointment policy, by charging the patients who broke the appointment a fee as per your office policy. |

Our Timeline

Day 1

Our Team will provide you with a letter of engagement, our comprehensive payment posting services, providing efficient and accurate handling of your payment transactions. With our expertise in the field, we ensure timely and secure posting of payments.

Day 7

After your dental practise accepts the letter of engagement, we will essentially take up to a week to comprehend your statements, paperwork, and other pertinent documents so that we can handle your payment posting jobs effectively and promptly without making any mistakes.

After Day 07

We will set up a target for, the number of claims that need to be posted on a regular basis, we ensure that we post as many claims as possible with efficiency and accuracy.

Monthly Review

Payment posting is a iterative process. To maintain accurate records, ongoing verification is necessary. We simply do a monthly assessment to ensure that your reports are error-free, and we’ll provide you an analysis report of your practise at the end of the month.

Day 60

You’ll have clear records, your front-desk employees will have enough time to focus on their work, and dentists can concentrate on what they do best—carefully treat the patients. When you outsource your payment posting activities, your practice can save an enormous amount of time.

Testimonials

|

|

|

| Dr.Lisa Anderson | Dr.Mark Robers | Dr. Sarah Thompson |

| Sparking Smiles Dental,California | Happy Teeth Family Dentistry | Perfect Smile Dental Clinic, New York |

| “Todays Dental Partners has revolutionized the way we handle Explanation of Benefits (EOB). Their electronic extraction system is a game-changer! It saves us an incredible amount of time and effort by automatically extracting and organizing EOB information. This has significantly improved our claims processing efficiency and accuracy.” | “We now have a clear and organized system that ensures accurate recording and reconciliation of payments. Todays Dental Partners’ payment posting services have transformed how we handle our practice’s financial processes. ” | “One of the primary problems I faced was the struggle to correctly verify patient balances due to delays in insurance providers updating their systems or inconsistencies in the data they supplied. This resulted in confusion, inaccurate records, and potential financial instability for my practice. However, ever since I enlisted the help of Today’s Dental Partners, these challenges have become a thing of the past. ” |

FAQs (Frequently Asked Questions)

How can index Explanation of Benefits assist during patient visits?

Indexed Explanation of Benefits allows for quick and easy retrieval of specific EOBs when patients have questions or concerns about their insurance coverage. Having organized and indexed records enables your front office staff to provide accurate information promptly, enhancing patient satisfaction and reducing waiting times. It improves communication with patients regarding their insurance claims and financial responsibilities.

How much time and effort does it take to implement the electronic extraction of Explanation of Benefits?

The implementation process varies depending on the size of your dental practice and the complexity of your existing systems. Reputable service providers typically work closely with your practice to ensure a smooth transition. They handle the technical aspects of implementation, including data integration and training, to minimize disruption and maximize the benefits of electronic extraction.

How can your payment verification services help me maintain financial stability and peace of mind?

By entrusting my payment verification tasks to your service, I can maintain financial stability and gain peace of mind. Your team’s meticulous verification process ensures that all electronic fund transfers and cheque deposits are accurately confirmed, reducing the risk of errors or missing payments. With up-to-date and reliable financial records, I can make informed financial decisions, effectively manage cash flow, and address any discrepancies promptly, ultimately fostering financial stability for my dental practice.

How does your service handle the security and privacy of my financial information?

The security and privacy of my financial information are of utmost importance to me. I would like to know how your service ensures the confidentiality and protection of my bank account data during the payment verification process.