Insurance Eligibility and Benefits Verification

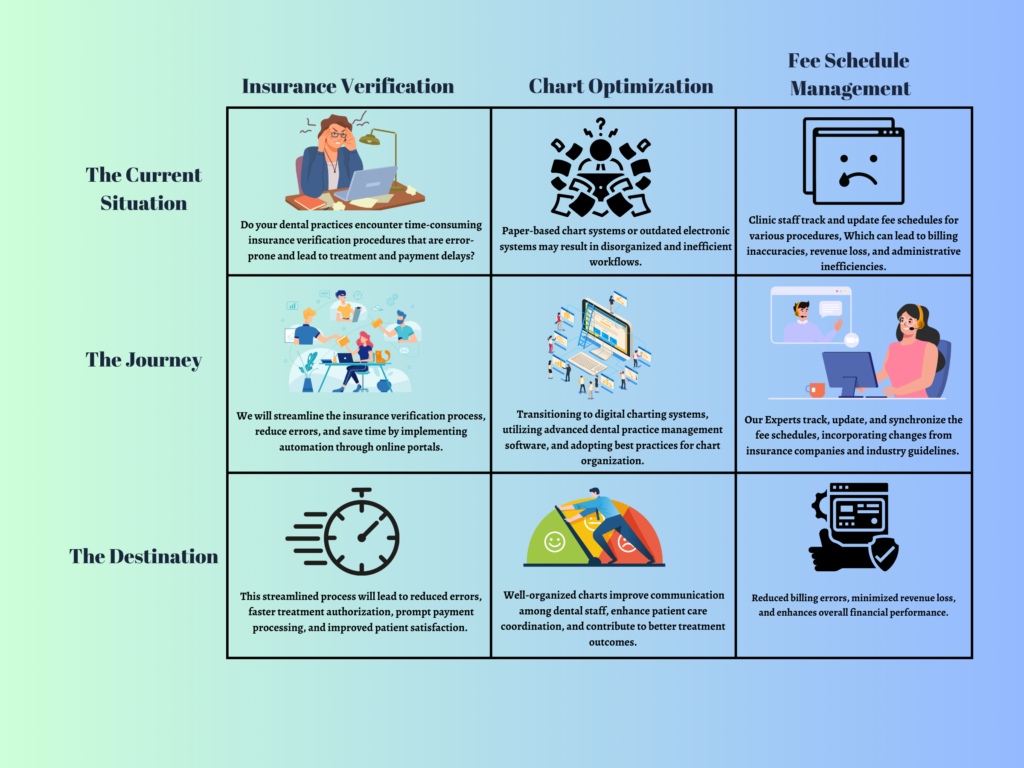

Insurance verification can be a laborious task for your front desk staff. Online resources may not always provide comprehensive benefit details, and calling insurance representatives can mean enduring lengthy wait times ranging from 15-90 minutes per verification with an average of about 30 mins per call. This valuable time could be better utilized by attending to other office responsibilities or providing quality care to your patients.

Streamlining insurance verification processes through our solutions enables your front desk staff to dedicate more time to essential tasks and patient care, leading to improved services and a better overall experience.

Pricing

- Basic

- $ 250

- Monthly

- 1-30 verifications/month

- Chart Optimization

- Contact Now

- Standard

- $ 650

- Monthly

- 31-75 verifications/month

- Chart Optimization

- Contact Now

- Plus

- $ 825

- Monthly

- 76-100 verifications/month

- Chart Optimization

- Contact Now

- Premium

- $ 825

- Monthly

- 100+ verifications/month

- Chart Optimization + PPV Verification

- Contact Now

| Service | Future | Same/ Next Day |

|---|---|---|

| PPO/ Indemnity Full Benefits | $4.11 | $4.55 |

| PPO/ Indemnity Partial Benefits | $1.75 | $2.25 |

| Medicaid Online | $0.72 | $0.72 |

| Eligibility Check Only/ Eligibility Failure | $0.95 | $0.95 |

| Create/ Editing an Existing Plan with New Information | $1.98 | $1.98 |

| Obtaining Fee schedule copies (upon request) | $2.25 per call | |

| Fee Schedule update | $0.135 per CDT code or $45 per fee schedule | |

Schedule a Meeting with our Insurance Team

Total Number of Hrs employee works =

Avg Cost for Indian Employee =

Avg Cost for Foreign Employee =

Brochure

e-Book

White Cost Savings Downloadable file

Case Study

White Paper

Elevate your business with our comprehensive white paper, meticulously crafted to provide an in-depth understanding of how our services can revolutionize your operations. Explore its concise yet impactful content to make informed decisions and drive sustainable growth.

Solo Dentist – Efficiently verify insurance eligibility and benefits, focus on providing exceptional care while streamlining administrative processes.

PPO / Indemnity Full Benefits – A comprehensive PPO/Indemnity Full Benefits service is crucial for solo dentists to offer their patients extensive coverage and flexibility in choosing dental providers. This service ensures that patients have access to a wide range of dental treatments and procedures while minimizing out-of-pocket costs.

PPO / Indemnity Partial Benefits – PPO/Indemnity Partial Benefits in dentistry offer solo dentists the opportunity to provide flexible coverage options for their patients. By offering these benefits, solo dentists can ensure that their patients have access to a broader network of dental providers and more comprehensive dental care. It allows patients to choose their preferred dentists while still receiving coverage for a portion of the treatment costs.

Medicaid Online – The Medicaid online service in dentistry provides solo dentists with the opportunity to expand their patient base and offer essential dental care to individuals covered by Medicaid. By participating in the Medicaid program, solo dentists can provide crucial oral healthcare services to low-income patients, ensuring they receive the treatment they need for their dental well-being.

Eligibility Check and eligibility Failure – Offering an eligibility check-only service or addressing eligibility failures is crucial for solo dentists. By providing an eligibility check-only option, solo dentists can efficiently verify patients’ insurance coverage before proceeding with treatment, ensuring a smoother billing process. Additionally, addressing eligibility failures helps dentists proactively address any coverage issues, provide alternative payment options, and minimize financial surprises for patients.

Editing an Existing Plan with New Information and Creating new plan – Whether it’s editing an existing dental plan with new information or creating a completely new plan, solo dentists can provide personalized dental care options to meet the evolving needs of their patients. By offering the flexibility to modify existing plans or develop new ones, solo dentists can tailor treatment options, coverage limits, and payment arrangements to ensure patients receive the most suitable dental care that aligns with their specific requirements.

Chart Optimization – Chart optimization is crucial for solo dentists to ensure efficient organization and accessibility of patient records. By implementing effective chart optimization strategies, solo dentists can streamline their workflows, improve patient care coordination, and enhance overall practice efficiency. Organized and well-maintained charts enable quick retrieval of information, accurate documentation, and seamless communication between dental team members.

Obtaining fee schedule copies – Providing fee schedule copies upon request by clients is an essential service offered by solo dentists. By promptly sharing fee schedules with clients, solo dentists ensure transparency and foster trust in their practice. This enables clients to have a clear understanding of the costs associated with different dental procedures, empowering them to make informed decisions about their oral healthcare.

Fee Schedule Update – Keeping fee schedules updated is crucial for solo dentists to ensure accurate and transparent pricing for their dental services. By regularly reviewing and updating fee schedules, solo dentists can align their pricing with industry standards, account for changes in overhead costs, and provide clients with fair and up-to-date pricing information. This commitment to maintaining updated fee schedules demonstrates professionalism and a dedication to delivering quality dental care.

Regional Group – Improve consistency across your group practices

PPO / Indemnity Full Benefits – For mid-sized dental firms, providing PPO/Indemnity Full Benefits allows them to offer their patients a robust dental insurance plan. This service helps establish the firm’s reputation and attract new patients by showcasing the comprehensive coverage, freedom of provider choice, and the peace of mind that comes with having full benefits.

PPO / Indemnity Partial Benefits – PPO/Indemnity Partial Benefits play a significant role in mid-sized dental practices. They enable these practices to offer their patients a wider range of coverage options, making dental care more accessible and affordable. Patients can enjoy the freedom to choose their preferred dental providers within the network, ensuring quality care while benefiting from partial coverage for their dental treatments.

Medicaid Online – The Medicaid online service in dentistry is of significant importance for mid-sized dental practices. It allows these practices to serve a broader population and offer comprehensive dental care to individuals who rely on Medicaid for their healthcare coverage. By participating in the Medicaid program, mid-sized dental practices can help improve access to oral health services and contribute to the overall well-being of their communities.

Eligibility Check and eligibility Failure – Mid-sized dental practices can greatly benefit from implementing an eligibility check-only service or effectively managing eligibility failures. By conducting eligibility checks upfront, these practices can streamline their operations, reduce administrative overhead, and improve the patient experience. Addressing eligibility failures promptly and offering flexible payment solutions can help retain patients and foster a positive reputation within the community.

Editing an Existing Plan with New Information and Creating new plan – Mid-sized dental practices understand the importance of adapting dental plans to changing circumstances. Whether it involves editing an existing plan with new information or creating a new plan altogether, mid-sized practices can provide comprehensive coverage options to meet the diverse needs of their patient base. By customizing plans, they can offer a range of treatment options, incorporate the latest advancements in dental care, and ensure patients receive optimal care while addressing their financial considerations.

Chart Optimization – Mid-sized dental practices can greatly benefit from chart optimization to manage a larger volume of patient records effectively. By implementing standardized charting formats, utilizing clear headings and categories, and leveraging digital record-keeping systems, mid-sized practices can enhance data accuracy, minimize errors, and improve the overall patient experience. Chart optimization also facilitates collaboration among dental professionals and enables efficient referral processes.

Obtaining fee schedule copies – Mid-sized dental practices understand the significance of promptly providing fee schedule copies to clients upon request. By offering transparent and readily accessible fee schedules, these practices demonstrate their commitment to open communication and patient satisfaction. Clients can review the fee schedules to understand the costs associated with various dental treatments, enabling them to plan their oral healthcare and budget accordingly.

Fee Schedule Update – Fee schedule updates are of significant importance for mid-sized dental practices. By conducting regular reviews and revisions, these practices can ensure that their pricing remains competitive, reflective of the services provided, and in line with industry trends. Regular fee schedule updates demonstrate a commitment to fairness, transparency, and delivering high-quality dental care to their clients.

National Group – Propel your practice to every corner of the nation

PPO / Indemnity Full Benefits – Large Dental Support Organizations (DSOs) can greatly benefit from offering PPO/Indemnity Full Benefits to their patients. With a focus on consistent and visually appealing website design, DSOs can provide a seamless user experience and promote their dental services on a global scale. This service enables patients to receive comprehensive coverage, access a network of preferred providers, and enjoy the advantages of full benefits across various locations.

PPO / Indemnity Partial Benefits –PPO/Indemnity Partial Benefits are highly advantageous for large Dental Service Organizations (DSOs). These benefits allow DSOs to offer their patients a comprehensive coverage option that spans across a vast network of dental providers. Patients can receive care from various specialists while receiving partial coverage for their treatments, making it convenient and cost-effective for them to access the dental care they need.

Medicaid Online – Large Dental Service Organizations (DSOs) can greatly benefit from participating in the Medicaid online service in dentistry. By offering dental care to individuals covered by Medicaid, DSOs can address the oral health needs of a diverse population. It provides an opportunity for DSOs to contribute to community health and well-being while expanding their patient base and strengthening their reputation as providers committed to accessible and affordable dental care.

Eligibility Check and eligibility Failure – For large Dental Service Organizations (DSOs), incorporating an eligibility check-only service or efficiently managing eligibility failures is essential. By conducting eligibility checks at the beginning of the patient journey, DSOs can optimize their workflow, improve revenue cycle management, and enhance patient satisfaction. Developing effective strategies to handle eligibility failures, such as offering financial counseling or alternative payment arrangements, demonstrates a commitment to patient care and strengthens relationships with insurance providers.

Editing an Existing Plan with New Information and Creating new plan – Large Dental Service Organizations (DSOs) excel in the realm of editing existing plans with new information or designing new plans to meet the demands of their patients. With a vast patient population and a wide range of dental needs, DSOs can leverage their resources to create tailored plans that encompass various treatment options and account for evolving healthcare dynamics. By continuously refining and innovating their dental plans, DSOs can offer comprehensive and flexible coverage to a diverse patient base.

Chart Optimization – For large Dental Service Organizations (DSOs), chart optimization is essential for managing extensive patient databases across multiple locations. By implementing standardized charting practices, utilizing electronic dental records, and integrating chart optimization with dental practice management software, DSOs can ensure consistent documentation, improve data security, and facilitate seamless information sharing among dental providers. Streamlined charting processes also enhance operational efficiency and support quality assurance initiatives.

Obtaining fee schedule copies – Large Dental Service Organizations (DSOs) prioritize the efficient sharing of fee schedule copies upon client request. By promptly providing comprehensive fee schedules, DSOs showcase their commitment to transparency and patient-centered care. Clients can review the fee schedules to gain insights into the costs of different dental procedures, facilitating financial planning and informed decision-making about their oral healthcare.

Fee Schedule Update – Large Dental Service Organizations (DSOs) prioritize comprehensive fee schedule updates to manage their extensive network of dental providers. By conducting regular reviews and revisions, DSOs can ensure consistency in pricing across multiple locations, account for market changes, and maintain a competitive edge in the industry. Up-to-date fee schedules contribute to transparent and reliable pricing information for clients accessing dental services within the organization.

Services Offered by Todays Dental Partners

Insurance Verification ComprehensiveExplore PPO/Indemnity benefits, Medicaid online, Eligibility checks, and Plan editing/creation. Simplify your dental insurance management with our video. Watch now and revolutionize your practice! Medicaid is a government-funded healthcare program that provides dental coverage to individuals. It includes preventive, diagnostic, and treatment services such as check-ups, cleanings, fillings, and extractions. Coverage varies by state, and eligibility requirements apply. We verify the patient’s eligibility, benefits and history on Medicaid website. Insurance eligibility check services in the dental industry verify a patient’s insurance coverage and determine their eligibility for dental services. An eligibility failure occurs when insurance coverage is inactive or limited. As a dental office, these services help you streamline operations and ensure transparency in financial matters. We assist patients by reviewing their current dental plan and making necessary updates or modifications required. This includes adjusting coverage percentages, annual maximums, and limitations. also update insurance information, and policy number details, ensuring accurate records reflect the changes. |

|

Chart OptimizationOptimize your dental charts with our streamlined services. Enhance efficiency and accuracy in record-keeping for a seamless dental practice. We manage the charts of the patients in the software to support future insurance claims. |

|

Fee Schedule ManagementEffortlessly access fee schedule copies upon client request. Stay up-to-date with fee schedule updates for accurate and transparent billing. Providing detailed information about dental procedure fees on client request. We work with insurance companies to update the fee schedule regularly or whenever needed on software. |

Our Timeline

Day 1

“”Our team will provide you with a letter of engagement, offering comprehensive insurance eligibility and benefits verification services. We specialize in efficiently and accurately handling the verification of insurance coverage and benefits for your patients. With our expertise in the field, we ensure timely and secure verification processes.”

Day 7

“Once your dental practice accepts the letter of engagement, we will need approximately one week to familiarize ourselves with your patient information, insurance policies, and relevant documents. This allows us to effectively and promptly verify insurance eligibility and benefits without any errors.”

Day 7-30

“We will set a target for the number of insurance eligibility and benefits verifications to be completed regularly. Our aim is to verify as many patients benefits verification as possible with efficiency and accuracy, ensuring your practice maintains up-to-date and precise insurance information.”

Day 30

“Insurance eligibility and benefits verification is an ongoing and iterative process. To ensure accurate records, we conduct monthly assessments to guarantee error-free reports. At the end of each month, we will provide you with an analysis report summarizing your practice’s insurance verification activities.”

Day 60

“By outsourcing your insurance eligibility and benefits verification tasks to us, you can expect well-maintained records and streamlined operations. Your front office staff will have more time to focus on their primary responsibilities, while dentists can fully concentrate on providing excellent patient care. Outsourcing these tasks will save your practice valuable time and resources.”

Testimonials

|

|

|

| Dr.Emily Johnson | Dr.Mark Davis | Dr.Sarah Collins, |

| Johnson Dental Care | Healthy Smiles Dentistry | Smile Dental Center |

| ” We used to dread calling insurance companies for verification. The long wait times and incomplete information were frustrating. However. with Todays dental services in place. We can easily verify insurance benefits online within limited time. It has made job much easier. allowing us to provide a higher level of service to our patients.” | “Since implementing the automated insurance verification system. our front desk staff has been able to focus on patient care rather than spending hours on the phone with insurance representatives. It has made our workflow more efficient and our patients appreciate the quicker check-in process.”*” | “The digital platform for insurance verification has been a game-changer for our office. We now have access to comprehensive benefit breakdowns at our fingertips. saving us time and providing accurate information to our patients. It has greatly improved our administrative processes and allowed us to deliver better service.” |

FAQs (Frequently Asked Questions)

Q.What is insurance verification, and why is it important for dental practices?

Insurance verification is the process of confirming a patient’s insurance coverage, benefits, and eligibility. It is crucial for dental practices to ensure accurate verification to avoid claim denials, reduce administrative burdens, and maximize reimbursements.

Q. Do I need to upgrade or switch my current Practice Management System to collaborate with your services if it’s outdated?

No, there’s no need to worry. Todays Dental Services seamlessly integrates with your current practice management system, regardless of its age or type. Whether you use mainstream, cloud-based, specialty, or proprietary software, you can still leverage our outsourced eligibility and benefits verification services.

Q. Is the patient’s information kept confidential and secure?

Yes, patient confidentiality and data security are of utmost importance to us. We follow strict protocols and adhere to HIPAA guidelines to ensure the privacy and security of patient information at all times.

Q. How can you get started with our insurance verification and claims services?

Getting started is simple. You can reach out to us through our website, phone, or email. Our team will guide you through the onboarding process and discuss the specific needs of your dental practice.

Q. How long does it take to receive reimbursements for dental insurance claims?

With our streamlined claims process, reimbursements are typically received within 10 business days. Our efficient systems and expertise in claim submission and follow-up minimize delays and expedite the reimbursement process.